Tired of family money arguments? This app brought us peace—and savings

Money misunderstandings at home used to stress us out—until we found a simple app that changed everything. No more guessing who paid for what or arguing over overspending. Now, we share expenses smoothly, stay on the same page, and actually talk *more* calmly about finances. It’s not just about tracking cents; it’s about building trust. If your family struggles with financial friction, you’re not alone—and there’s a gentler way forward. This isn’t a story about budgets or spreadsheets. It’s about how a tiny tool helped us reconnect, reduce tension, and finally stop letting money quietly pull us apart.

The Little Fights That Almost Broke Us

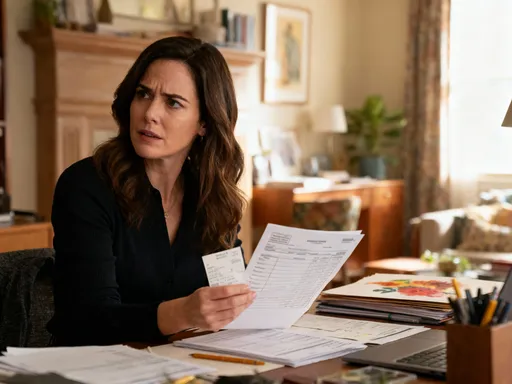

It wasn’t one big blowout that made me realize we had a problem. It was the slow drip of small moments—like when my sister borrowed $20 for milk and forgot to pay me back. Again. Or when my dad muttered under his breath after paying the electric bill, saying things like, “I guess someone left every light on all night.” We weren’t mad at each other, not really. But those tiny comments, the unspoken eye rolls, the silent resentments—they added up. I started dreading family dinners because I knew money would come up, even if no one said the word.

Looking back, I see now that it wasn’t about the money itself. It was about fairness. It was about feeling seen. When I paid for the internet and no one acknowledged it, I felt invisible. When my cousin used the shared printer without refilling the ink, it felt like she didn’t care. We were all trying, in our own ways, but we were operating in the dark. No one kept track. No one reminded. And every forgotten debt or surprise bill turned into a tiny crack in our connection.

Then one night, after a quiet but tense dinner where my aunt mentioned, “I hope someone remembers the water bill,” I broke down. Not dramatically—just a tear or two while loading the dishwasher. My cousin noticed. “You okay?” she asked. And instead of saying “I’m fine,” like I always did, I said, “No. I’m tired of feeling like I’m the only one who cares about this stuff.” That moment changed everything. Because for the first time, we talked—not about who was right or wrong, but about how it all made us feel.

Discovering the App That Felt Like a Family Translator

A few days later, I ran into an old friend at the grocery store. We caught up in the cereal aisle, and somehow the conversation turned to family life. She mentioned how she and her husband use an app to track shared expenses—no drama, no guessing. I admit, I rolled my eyes at first. Another app? Really? But then she said something that stuck with me: “It’s not about the money. It’s about not having to think about the money.” That made sense. I didn’t want another chore. I wanted peace.

That night, I downloaded the app she recommended. I wasn’t expecting much. But from the first click, it felt different. No confusing menus. No financial jargon. Just a clean screen where I could create a group called “Family Home.” I added my dad, my sister, and my cousin. We set up recurring bills—the internet, electricity, water, even the streaming subscriptions we all used. Each person could mark when they paid, and the app would split the cost automatically. If someone paid more, the app showed who owed what.

The first time it worked, I almost cried. My brother had paid for concert tickets for all of us. In the past, that would’ve turned into a week of “Did you get my $15?” texts. This time, he logged it in the app, tagged each of us, and sent a quick note: “Tickets settled—check your balance.” No awkwardness. No chasing. Just clarity. For the first time, money didn’t feel like a weapon. It felt like a shared language we were finally learning together.

How One Notification Reduced a Week of Tension

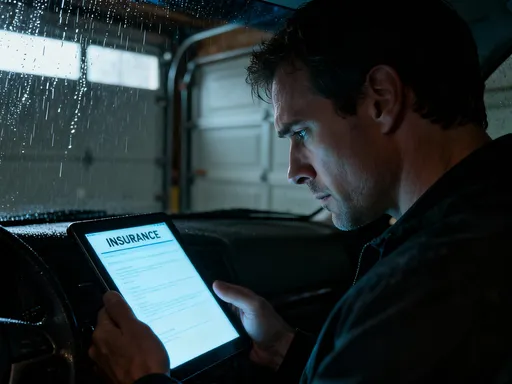

Then came the water bill. It arrived one Tuesday morning—$180. Our usual bill was around $90. My heart sank. I could already hear the comments: “Who’s been taking long showers?” “Did someone leave the hose running?” In the past, this kind of surprise would’ve spiraled. Someone would get defensive. Someone else would shut down. And for days, the air in the house would feel heavy.

But this time, something different happened. The app sent a notification: “Water bill due—$180. Paid by Dad. Balance updated.” That’s it. No drama. No blame. Just facts. That evening, we all gathered in the kitchen, phones in hand, pulling up the app. We looked at the usage history. The spike started two weeks ago—right after the garden irrigation system was turned on. No one had meant to waste water. We’d just forgotten to adjust the timer.

Instead of arguing, we laughed. “Oh, that’s why the grass looked so green,” my cousin said. We adjusted the schedule, split the extra cost fairly, and moved on. That single notification didn’t just alert us to pay—it changed the tone of the conversation. It kept things neutral. It kept us focused on solving the problem, not assigning fault. And in that moment, I realized: technology didn’t fix our relationship. But it gave us a better way to navigate the hard parts.

Teaching Teens Financial Awareness Without Lectures

Getting teens to care about money is like asking them to enjoy broccoli—possible, but not easy. My 16-year-old cousin, Maya, was no exception. She loved her freedom—ordering food, buying clothes, going out with friends. But when it came to money, she’d shrug and say, “I’ll figure it out later.” I wanted to help, but I didn’t want to lecture. I didn’t want to be “the money police.”

So I invited her to join the family group in the app. I didn’t make it a demand. I said, “Hey, want to see how much you’ve saved this month?” At first, she ignored it. But then, she wanted a new pair of noise-canceling headphones—$120. I didn’t say a word. I just watched. She opened the app, checked her balance, and sighed. “I’m $40 short.”

Instead of asking for more money, she did something surprising. She set a savings goal in the app. Every time she got cash for babysitting or skipped a coffee run, she logged it. Two weeks later, she bought the headphones—proudly, with her own money. “I didn’t even miss the little things I skipped,” she told me. “It felt good to wait.” That moment meant more to me than any lecture I could’ve given. The app didn’t preach. It showed her the power of patience, one small choice at a time.

From Silent Resentment to Shared Goals

We used to avoid money talks like they were landmines. Now, we look forward to them. Every Sunday night, we gather in the living room with tea or hot chocolate. For ten minutes, we open the app and do a “money check-in.” We review what we’ve spent, adjust for surprises, and celebrate wins—like when we cut our electricity bill by 15% just by being more mindful.

These little meetings aren’t about control. They’re about connection. We’ve started dreaming bigger. Last month, we created a shared goal: a family trip to the mountains. We set a target, split the cost, and started saving together. Every time someone adds money, the app shows our progress. We cheer when we hit milestones. It’s become a ritual—something we all look forward to.

But the real change isn’t in the savings. It’s in how we talk to each other. We’re more honest. More patient. We listen more. Money isn’t a source of shame or secrecy anymore. It’s a tool we use to build something better—together. And that shift? That didn’t come from the app alone. It came from showing up, week after week, choosing to be on the same team.

Why Simplicity Beats Fancy Features

I’ll admit, I tried other apps before this one. Some promised AI-powered forecasts. Others had colorful charts and investment tips. One even suggested stocks based on my spending habits. But they were overwhelming. They made me feel like I needed a finance degree just to track a grocery bill. I’d open them, get confused, and close them without doing anything.

The app we use doesn’t try to do everything. It does a few things—and it does them well. It sends clear reminders. It keeps a timeline of who paid what. It shows balances in plain language. No graphs. No jargon. Just simplicity. That’s why it works. Because real life isn’t complicated by design. It gets complicated when we overthink it.

Technology should make life easier, not add another layer of stress. This app understands that. It doesn’t nag. It doesn’t judge. It just sits quietly in the background, ready when we need it. It’s like a good kitchen tool—reliable, useful, and never in the way. And sometimes, the most powerful tools are the ones that don’t demand your attention.

A Calmer Home, One Reminder at a Time

Today, our home feels different. Lighter. Kinder. We still have different spending styles—my dad likes to plan everything, while my cousin is more spontaneous. But instead of seeing those differences as problems, we see them as part of what makes us us. The app didn’t erase our quirks. It helped us respect them.

Money no longer lives in the shadows. It’s out in the open, discussed with care. We still have surprises. We still make mistakes. But now, when something comes up, we face it together. We look at the app, talk it through, and decide what to do—calmly, fairly, as a team.

Peace didn’t come from saving money. It came from feeling understood. From knowing that someone else is looking at the same numbers, sharing the same responsibility, caring about the same home. The app didn’t fix our family. But it gave us a way to show up for each other—without words, sometimes, just a simple notification saying, “This is taken care of.”

If you’re tired of the little money fights, know this: you’re not alone. And you don’t need a perfect system. You just need one small step toward clarity. One shared account. One honest conversation. Because beneath every financial argument is a deeper need—to feel seen, to feel trusted, to feel like you belong. And sometimes, the simplest tools can help us find our way back to each other. Try it. Not for the savings. Not for the efficiency. Do it for the peace. Because that? That’s priceless.